2017 overview

In 2017 the SAFER registered an increase in both the number and value of vineyard transactions in France. The number of transactions was the highest in 25 years, with 9,460 sales, an increase of 2.8% from 2016, and the total area sold was 16,900 hectares, a 7.9% increase compared to 2016. The total value of transactions also increased, by 59% to 1.3 billion Euros, largely as the result of several exceptional sales: the 10 highest value transactions represented 31% of the total. These included the sale of Clos de Tart in Burgundy for a reported 280 million Euros, Chateau Troplong Mondot in Saint-Emilion for a reported 178 million Euros, Domaine de Nalys in Châteauneuf-du-Pape for a reported 45 million Euros and Clos Rougeard in the Loire Valey for a reported 14 million Euros.

Although there have been gradual increases in French vineyard prices over the last 25 years, strong demand coupled with very limited supply continues to drive up prices at a much higher rate in the most prestigious appellations.

The total value of all French AOC vineyards currently stands at €69.4 billion (up 2.3% vs 2016), of which 86% is concentrated in three regions that cover only 45% of the surface area: Champagne, which alone accounts for 55% of the total value (€38 billion and only 7% of the planted area), Bordeaux (€12.7 billion, 28% of the surface area) and Burgundy-Beaujolais-Savoie-Jura (€8.8 billion, 10% of the surface area).

The SAFER statistics

All of the price information used in this article is sourced from statistics published annually by the SAFER (les Sociétés d’Aménagement Foncier et d’Etablissement Rural), the government-controlled agencies tasked with overseeing rural land sales. This is the only publicly available data on French vineyard prices and is based on completed transactions. However, this data does not always provide a completely accurate picture of the market, notably where a transaction involves the sale of shares in a company, which may own assets other than just vineyards, or where buildings might account for a significant proportion of the value of an estate that has been sold.

The big picture

The value of all French AOC vineyards increased by 2.3% in 2017, while all of the main French wine regions also registered increases:

- +7.2% in Alsace.

- +5.5% in the Rhône

- +4.9% in Burgundy-Beaujolais-Savoie-Jura

- +3.8% in the Loire Valley

- +3.1% in Bordeaux-Aquitaine

- +0.8% in Champagne

- +8.1% in Charentes-Cognac

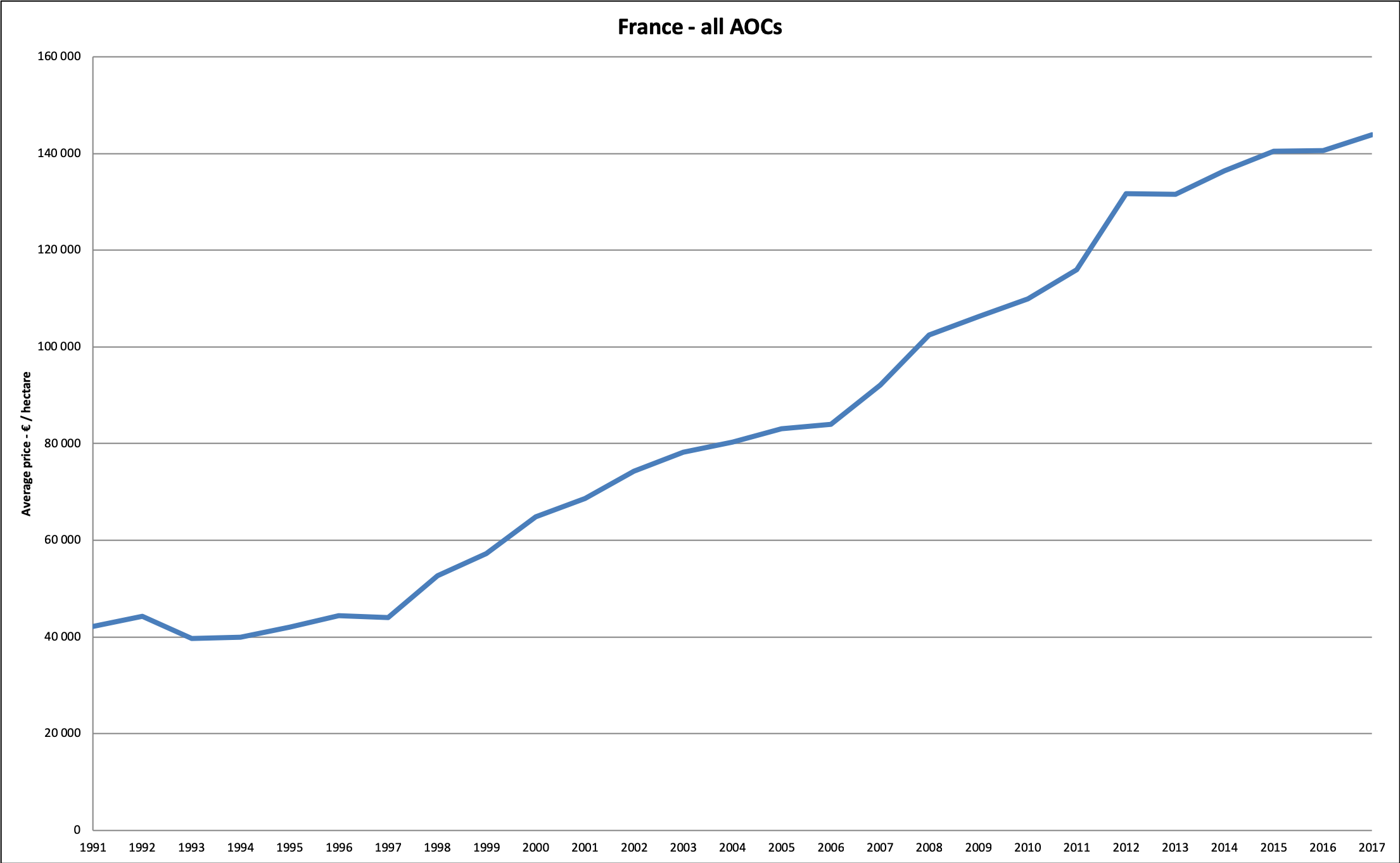

Since the SAFER started publishing detailed price data in 1991, the average price of French AOC vineyards has increased by 241%, from 42,200 €/hectare to 143,900 €/hectare.

The Champagne effect

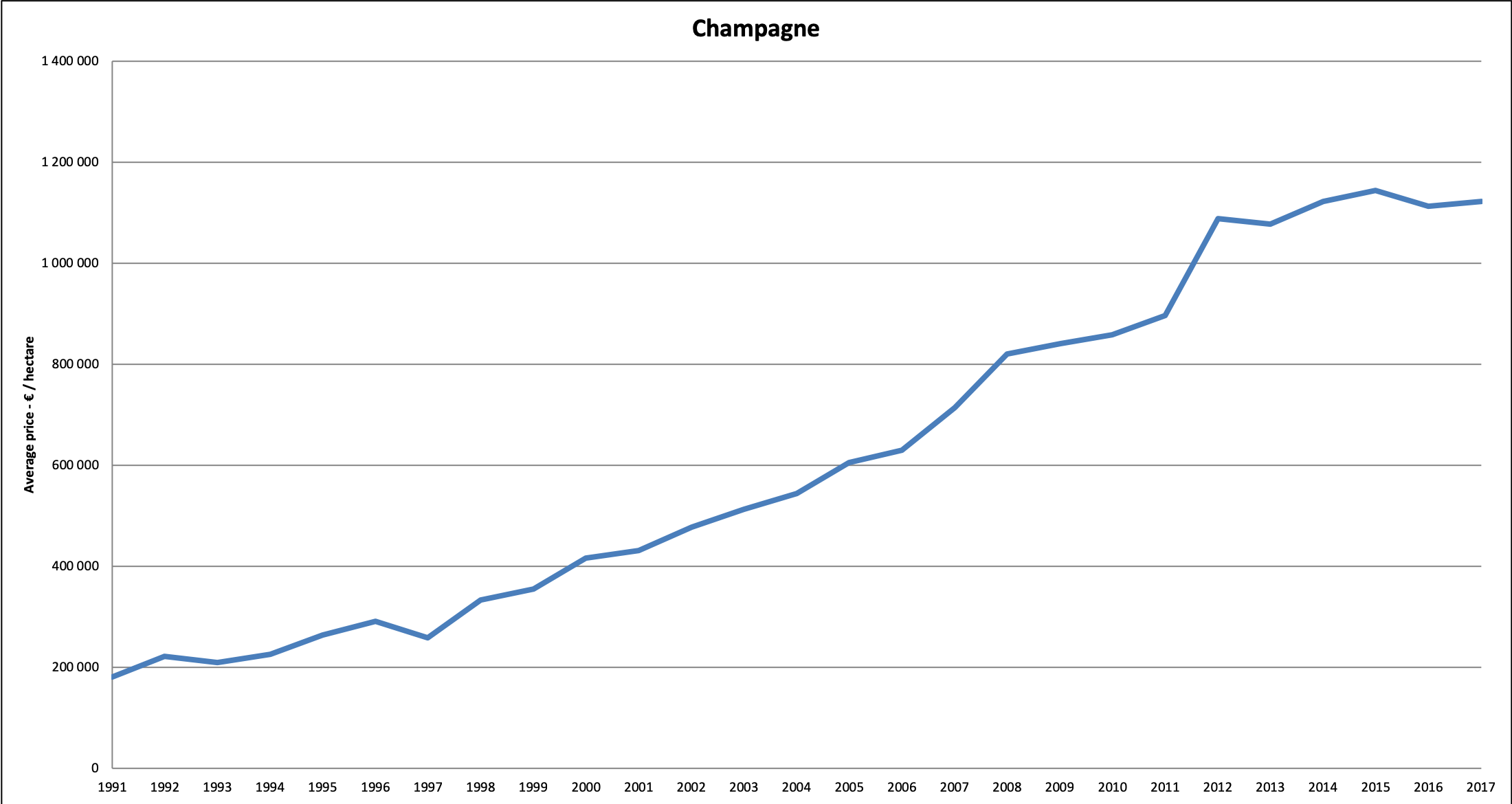

The above figure is distorted by a 515% increase in the average value of vineyards in Champagne over this period; from 195,055 €/hectare to 1,200,995 €/hectare.

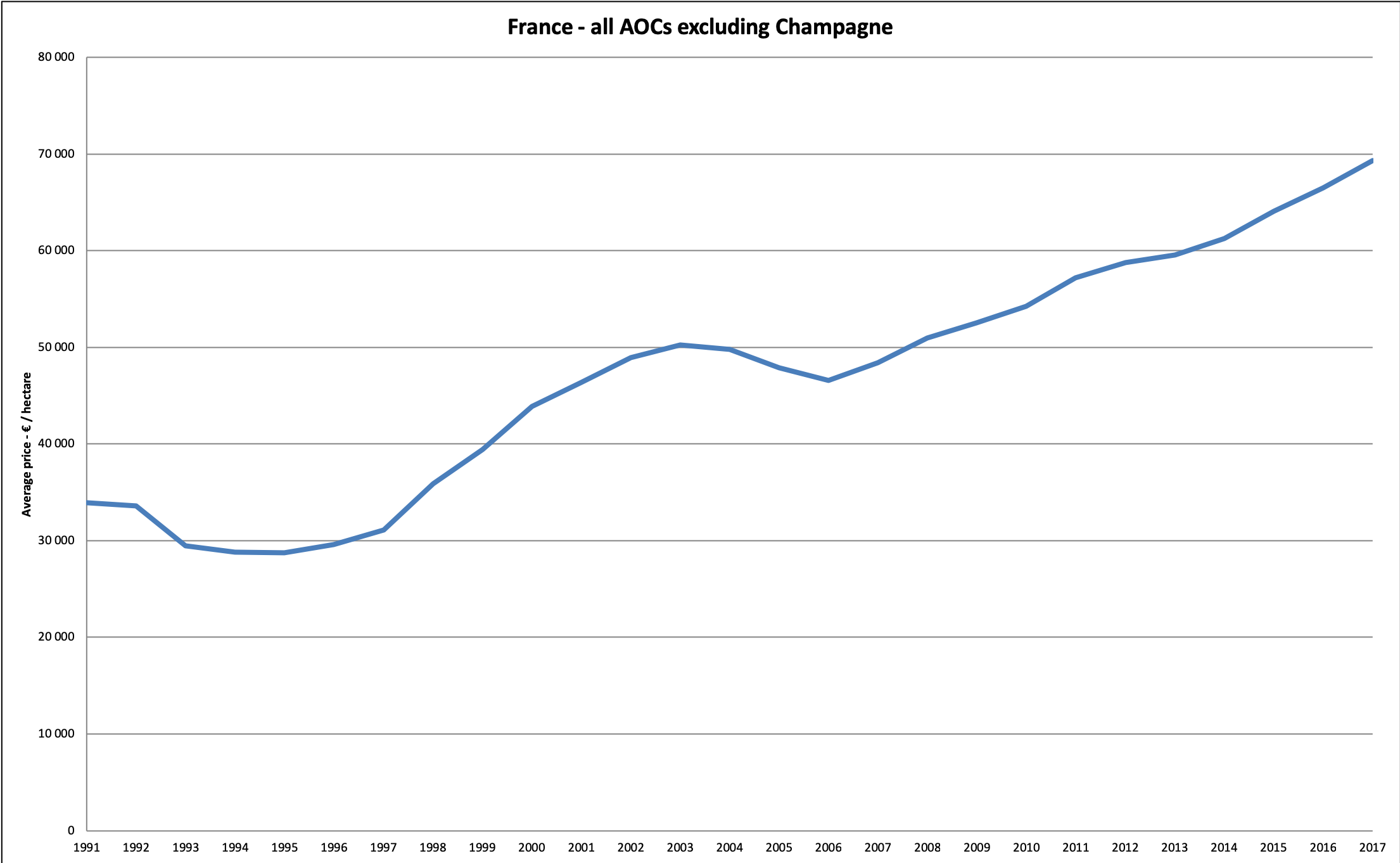

Excluding AOC Champagne vineyards there has still been a 104% increase in vineyard values over the period, with the average price of French AOC vineyards increasing from 33,919 €/hectare to 69,343 €/hectare between 1991 and 2017.

National variations

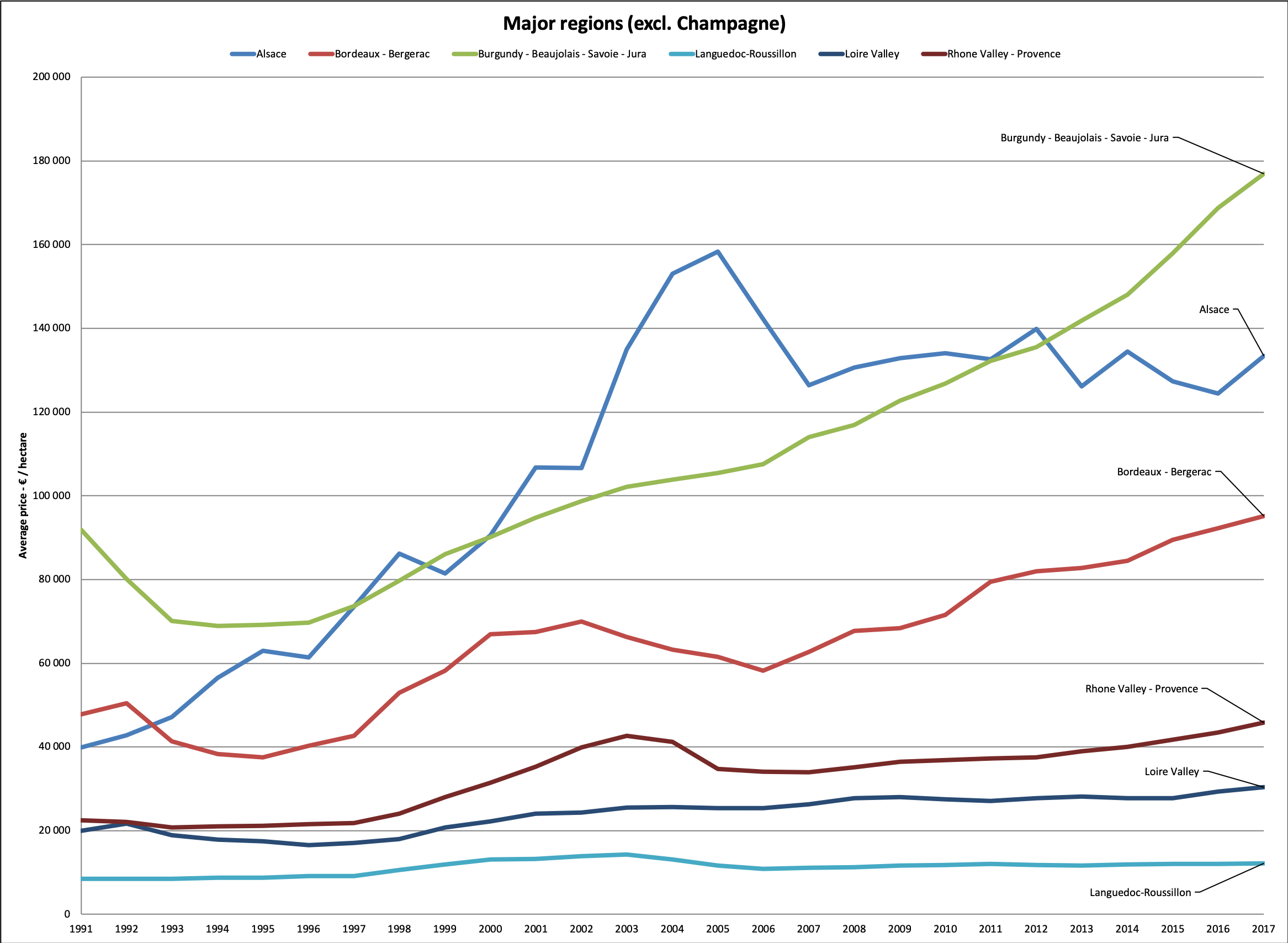

If we break this figure down into the major regions we can see that prices have progressed more in some regions than in others. Those regions with a high proportion of prestigious appellations, such as Bordeaux and Burgundy, have typically seen the largest increases. Between 1991 and 2017 prices increased by 234% in Alsace; 99% in Bordeaux; 93% in Burgundy – Beaujolais – Savoie – Jura; 104% in Rhone – Provence; 52% in the Loire Valley; and 44% in the Languedoc-Roussillon.

Regional variations

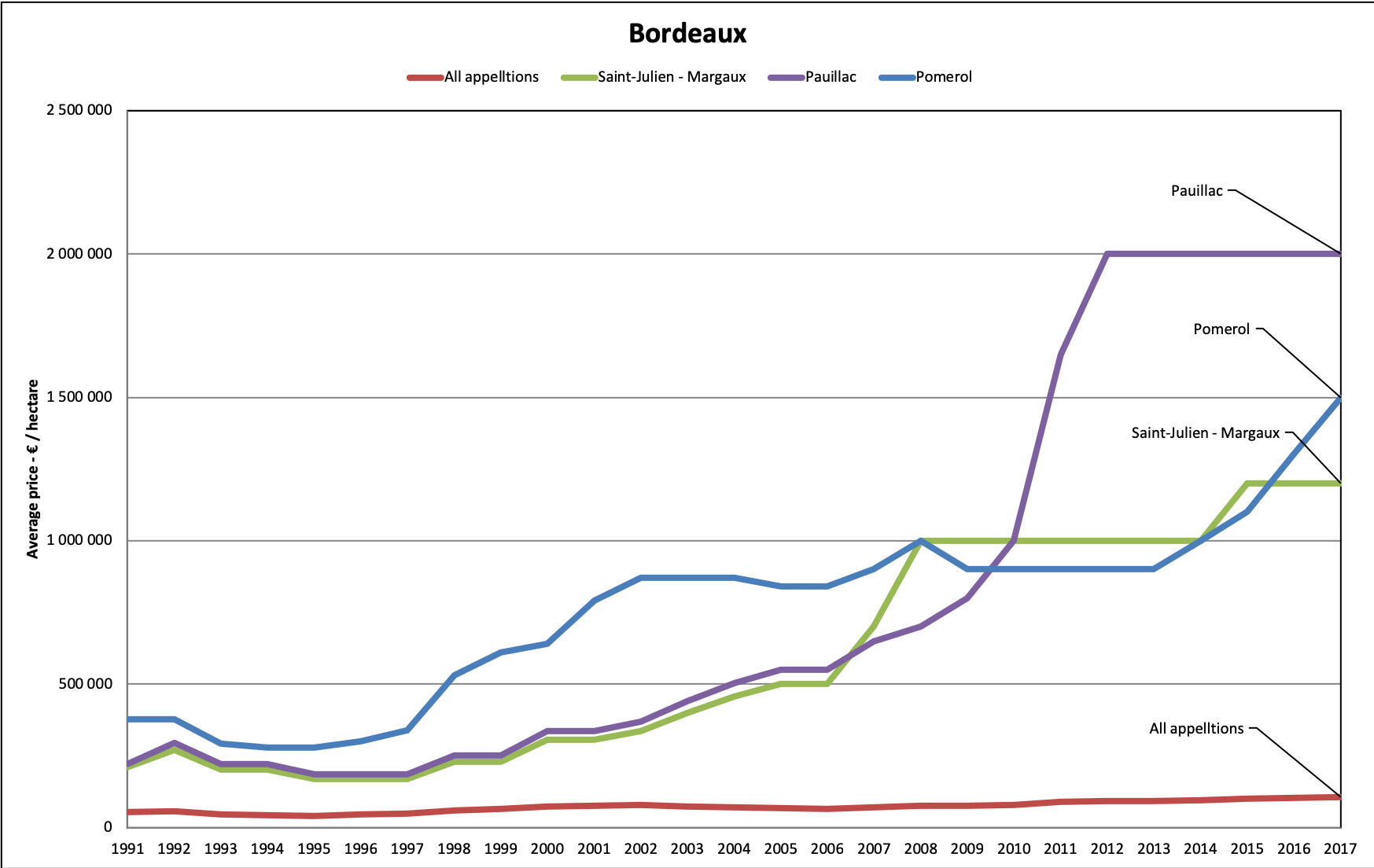

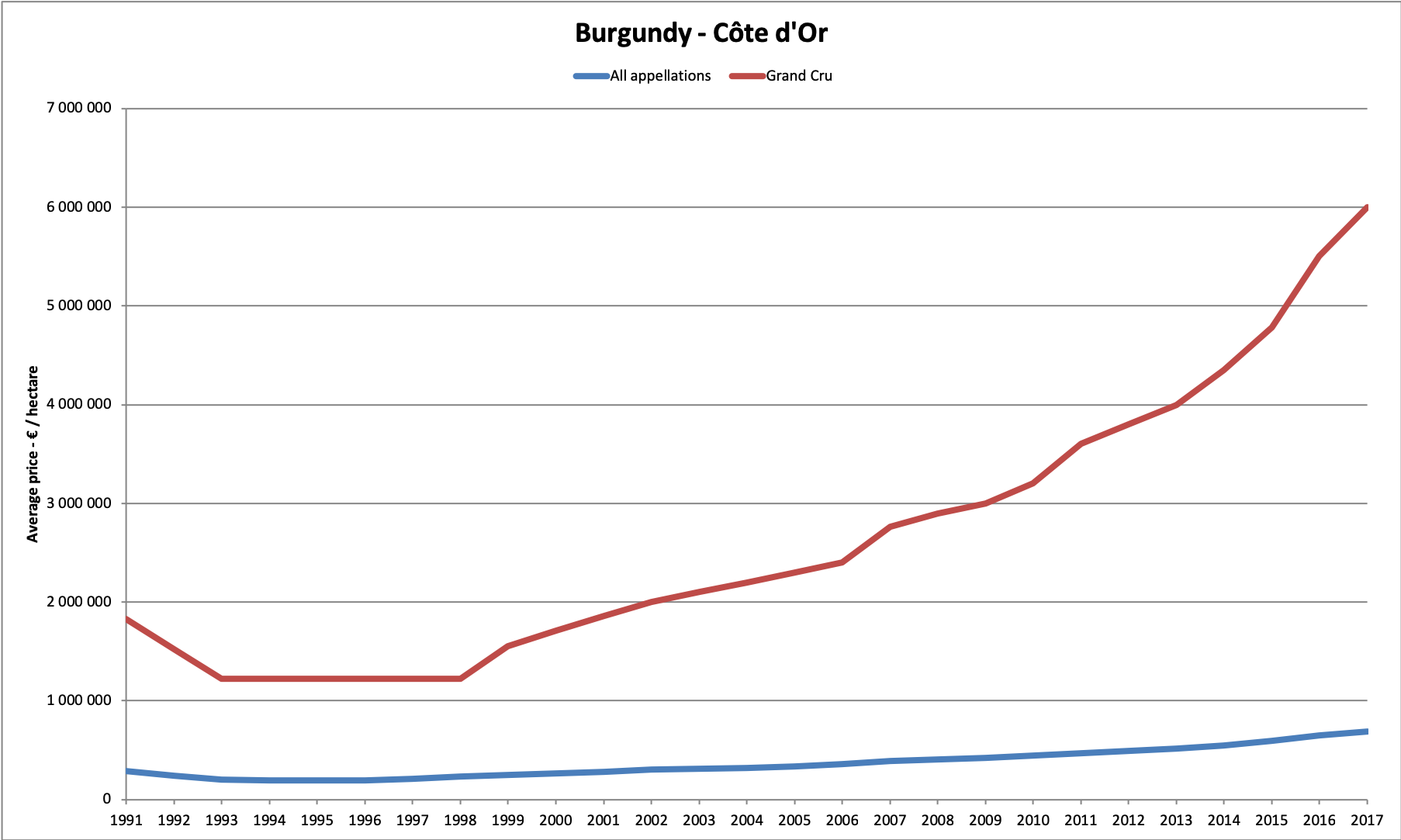

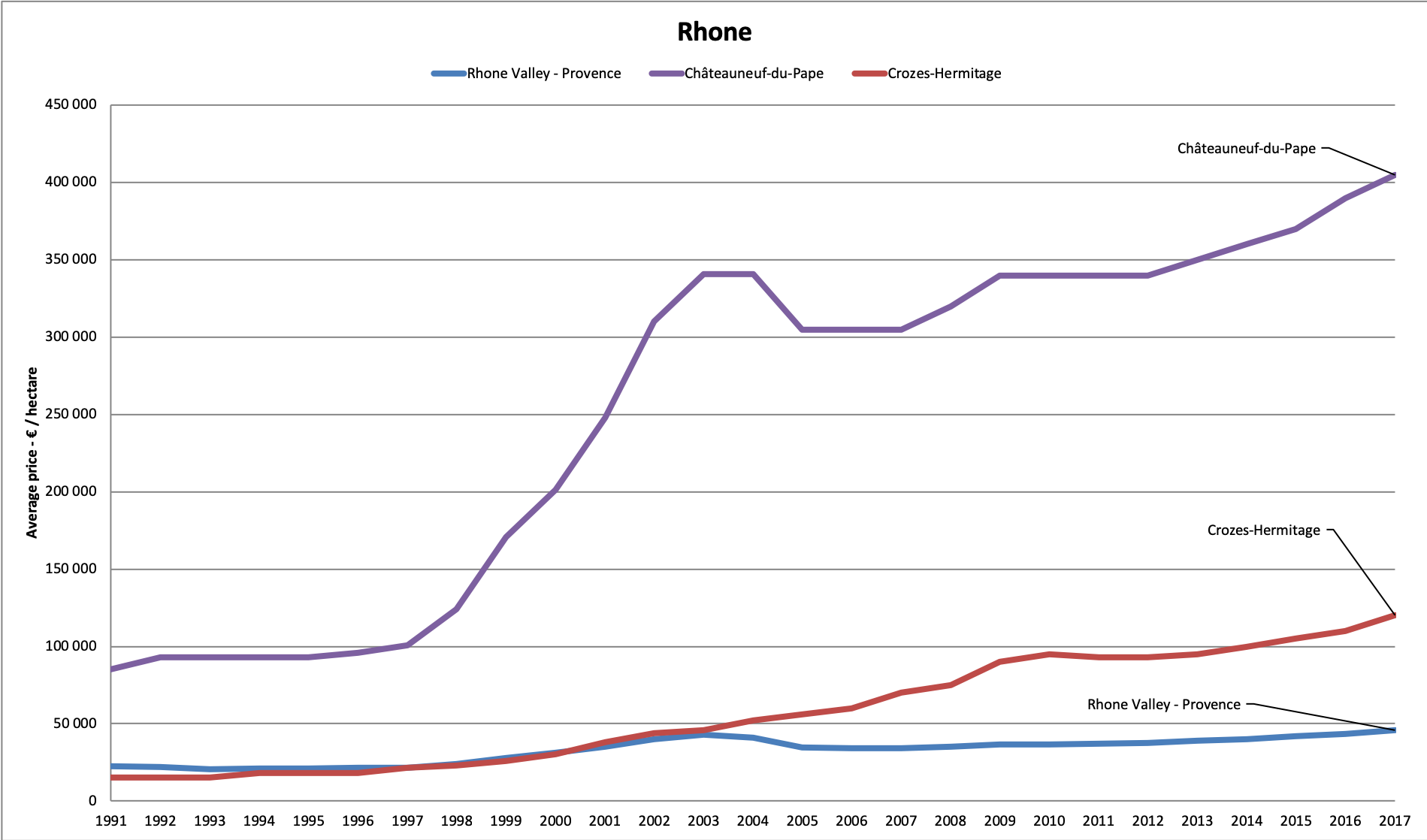

We need to look at prices in individual appellations to fully understand the pattern of diverging values. While no region as a whole has matched the price increases recorded in Champagne, several other appellations have experienced similar levels of price appreciation: Pauillac (+801%), Saint-Julien and Margaux (+469%), Pomerol (+297%), Burgundy’s Grand Cru AOCs (+228%), Crozes-Hermitage (+687%) and Châteauneuf-du-Pape (+375%).

Even in those regions that have experienced more modest rises in average prices, such as the Loire Valley and the Languedoc-Roussillon, prices of vineyards in the appellations producing the most sought-after wines have increased at a faster rate. Pic Saint Loup in the Languedoc-Roussillon has seen a 305% increase in the average price, from 9,880 €/hectare to 40,000 €/hectare, as against a 44% increase for the region as a whole. In the Loire Valley vineyard prices in Sancerre have increased by 100%, from 80,000 €/hectare to 160,000 €/hectare, as against a 52% increase for the region as a whole.

Highs and lows

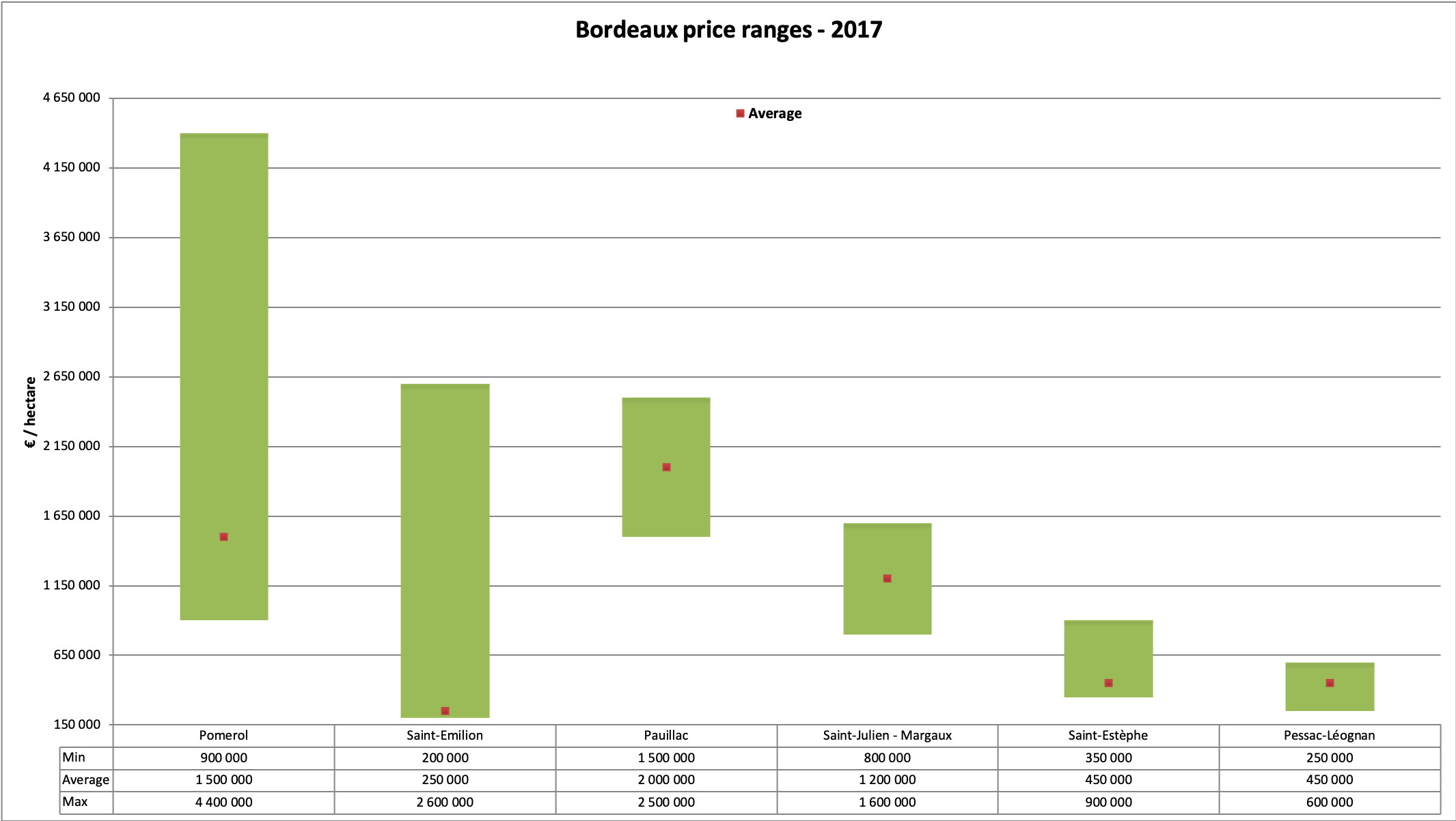

The above figures are based on average prices per hectare. The SAFER also publish the maximum and minimum price paid per hectare in each appellation. A look at these figures reveals significant price variation in some of the most prestigious appellations, reflecting the extent to which buyers are willing to pay a premium for the best vineyards in those appellations. This is most notable in Saint-Emilion, where the highest price recorded by the SAFER in 2017 was 2,600,000 €/hectare, more than ten times the average price of 250,000 €/hectare. In contrast, the highest price for regional AOC Bordeaux vineyards in 2017 was 25,000 €/hectare, versus an average price of 16,000 €/hectare.

The situation appears less marked in Burgundy, where the price of Grand Cru vineyards was between 2,750,000 €/hectare and 13,950,000 €/hectare in 2017, while regional AOC Bourgogne vineyards prices ranged from 12,700 €/hectare to 70,500 €/hectare. However, these figures would suggest some gaps in the SAFER data given the reported 37 million €/hectare paid for Clos de Tart last October.

Appellation, appellation, appellation

Many vineyards in France’s most prestigious appellations are now out of reach for most buyers. Top estates in the major wine regions have become trophy assets, valued more for their rarity and reputation than for their return on investment, and this has had a knock-on effect on the price of other vineyards in these appellations.

The importance of location, or in this case appellation, cannot be underestimated. One only has to look at the relative cost of vineyards in Saint-Emilion and Castillon, neighbouring appellations, to see how the reputation of an appellation impacts not only the value of the wines but also the value of the vineyards. In spite of some excellent wines now being produced in Castillon, including by several highly respected Saint-Emilion growers who purchased vineyards there in recent years, the average value of vineyards in Castillon has in fact decreased since 1991, while prices in Saint-Emilion have risen by more than 60%.

For those who can afford to, it still makes sense to invest in the better known appellations, where the wines are generally easier to sell and command a higher price. However, it is important not to fall into the trap of paying for prestige over profitability. Unless you are willing to sacrifice current profitability for the possibility of future capital appreciation, the economics of any vineyard purchase have to make sense. Paying more for a vineyard in a prestigious appellation does not guarantee a better return on investment.

While the value of some vineyards has little correlation to the financial returns they will generate, in most cases the two remain inextricably linked.